Strategic Debt Recycling: Transforming Liabilities into Wealth Opportunities

In today’s fast-paced world, it is essential to continuously explore innovative ways to build wealth and secure our financial future. One such strategy gaining popularity is strategic debt recycling. This concept involves utilizing existing liabilities to create wealth opportunities, enabling us to generate income while reducing our debt burden simultaneously. In this article, we will delve into the nitty-gritty of strategic debt recycling, its fundamental principles, and the steps involved in its implementation.

Understanding the Concept of Strategic Debt Recycling

Before we dive into the specifics, let’s grasp the basic principles that underpin strategic debt recycling. At its core, this strategy revolves around leveraging our accumulated debt to acquire appreciating assets. By redirecting our borrowed funds from non-productive areas, such as consumer debt or depreciating assets, towards growth-oriented investments, we can effectively accelerate our journey toward financial prosperity.

Strategic debt recycling is not a one-size-fits-all approach. It requires careful analysis and consideration of individual financial circumstances and goals. By understanding the basic principles and mechanics of this strategy, individuals can make informed decisions and take advantage of the potential benefits it offers.

The Basic Principles of Debt Recycling

Debt recycling is grounded in a few fundamental principles. Firstly, it emphasizes the importance of leveraging existing liabilities strategically, since not all debts are created equal. It’s crucial to identify and differentiate between “good” and “bad” debt. Good debt refers to loans or credit used to acquire assets that have the potential to appreciate in value or generate income. Bad debt, on the other hand, includes high-interest consumer debt or loans associated with assets that depreciate over time.

Secondly, debt recycling underscores the significance of redirecting the funds generated from debt consolidation or refinancing towards investments that have the potential to generate positive returns over time. This approach allows individuals to make the most of their borrowed funds by channeling them into income-generating assets or investments with growth potential.

Lastly, this strategy necessitates discipline and a long-term perspective, as wealth accumulation through strategic debt recycling is a gradual process. It requires individuals to stay committed to their financial goals and make informed decisions based on careful analysis and evaluation of investment opportunities.

The Role of Liabilities in Debt Recycling

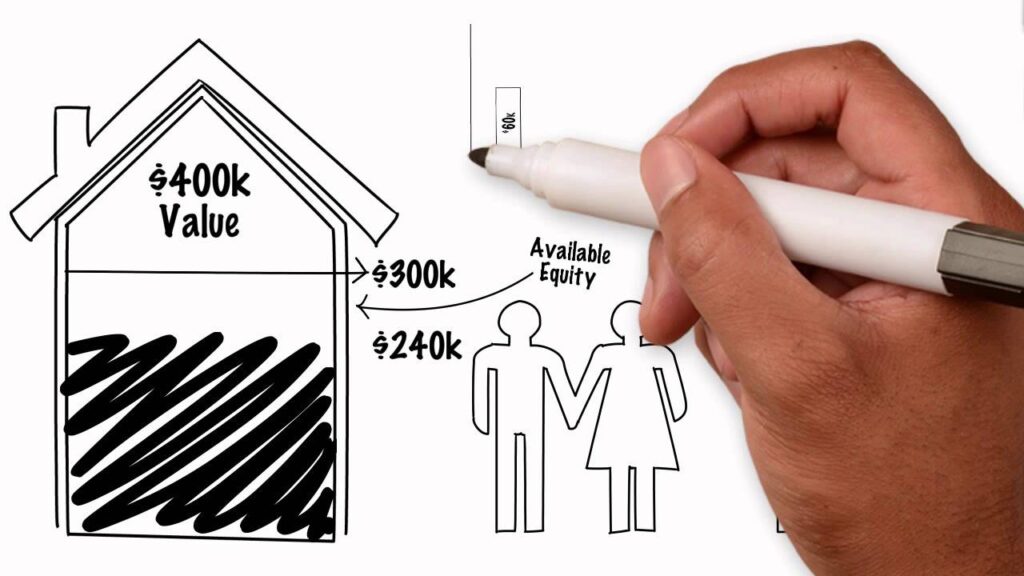

Liabilities, usually seen as financial burdens, play a crucial role in debt recycling. By harnessing these liabilities intelligently, we can transform them into powerful wealth-building tools. The key lies in identifying and isolating debts with higher interest rates or those associated with depreciating assets.

For example, credit card debt often carries high-interest rates, making it a prime candidate for debt recycling. By consolidating this debt into a lower-interest loan or line of credit, individuals can free up cash flow and redirect it towards investments that are expected to appreciate in value. This strategic move allows individuals to reduce the overall cost of their debt while simultaneously building wealth through the growth of their investments.

Similarly, debts associated with depreciating assets, such as car loans, can be strategically managed through debt recycling. By refinancing these loans or redirecting the funds allocated for monthly payments towards income-generating assets, individuals can mitigate the negative impact of these liabilities and potentially turn them into positive contributors to their overall financial well-being.

Debt recycling is not without risks. It requires careful planning, analysis, and a comprehensive understanding of one’s financial situation. It’s essential to consult with financial professionals or advisors who specialize in this strategy to ensure its suitability and effectiveness in individual cases.

In conclusion, strategic debt recycling offers individuals the opportunity to leverage their existing debt to acquire appreciating assets and accelerate their journey toward financial prosperity. By understanding the basic principles and mechanics of this strategy, individuals can make informed decisions and potentially unlock the true potential of their debt, paving the way for solid financial growth.

The Process of Strategic Debt Recycling

Now that we have grasped the underlying principles, let’s explore the steps involved in implementing a successful debt-recycling strategy.

Debt recycling is a financial strategy that involves optimizing debt structure and redirecting freed-up funds toward acquiring appreciating assets. By strategically managing debt and investing in assets that generate ongoing income or appreciation, individuals can build long-term financial stability and prosperity. Visit https://morven-house.com/commercial-buyers-agent-an-essential-partner-in-your-investment-strategy/ to read about Commercial Buyers Agent: An Essential Partner in Your Investment Strategy.

Steps Involved in Debt Recycling

The process of strategic debt recycling typically begins with a comprehensive evaluation of our existing debt portfolio. This evaluation enables us to identify and prioritize debts with high-interest rates or those tied to assets with minimal growth potential. By understanding the composition of our debts, we can make informed decisions on how to optimize our debt structure.

Once we have identified the debts that need to be addressed, we can explore refinancing or debt consolidation options. Refinancing involves replacing existing debt with a new loan that offers better terms, such as lower interest rates or longer repayment periods. Debt consolidation, on the other hand, involves combining multiple debts into a single loan, simplifying the repayment process.

With our debts streamlined, the next step involves redirecting the freed-up funds obtained from the refinancing or debt consolidation towards acquiring appreciating assets. These assets can be anything from shares, property, or even a business venture. The goal is to invest in assets that have the potential to generate ongoing income or appreciate in value over time, providing a positive return on investment.

As the cycle continues, the income generated by the acquired assets can be utilized to repay the remaining debt and build equity. This iterative process of recycling debt and accumulating wealth sets the stage for long-term financial stability and prosperity.

Key Factors to Consider in Debt Recycling

While implementing a debt recycling strategy, certain factors require careful consideration. Firstly, it is essential to assess the risks associated with the selected assets while balancing them against the prospective returns they offer. A thorough financial analysis and professional advice can help us navigate this complex terrain.

Furthermore, as with any investment strategy, it is crucial to be mindful of market conditions and fluctuations. Regular monitoring of our investments ensures that necessary adjustments can be made promptly, safeguarding our financial interests.

Additionally, it is important to consider the tax implications of debt recycling. Depending on the jurisdiction and specific circumstances, there may be tax benefits or consequences associated with the strategy. Seeking guidance from a tax professional can help us understand and optimize the tax implications of our debt recycling efforts.

Moreover, maintaining a disciplined approach to debt management is crucial for the success of the strategy. This includes making timely repayments, avoiding unnecessary debt, and continuously reassessing our financial goals and priorities.

In conclusion, debt recycling is a dynamic and strategic approach to managing debt and building wealth. By evaluating and optimizing our debt portfolio, redirecting freed-up funds towards appreciating assets, and considering key factors such as risk, market conditions, and tax implications, individuals can pave the way for long-term financial stability and prosperity.

Benefits of Strategic Debt Recycling

The practice of strategic debt recycling offers numerous benefits, both in the short and long term.

Debt recycling is not just a financial strategy; it is a way to optimize our financial well-being and achieve long-term wealth accumulation. By strategically managing our debt, we can unlock a world of financial advantages and opportunities.

Financial Advantages of Debt Recycling

One significant advantage of debt recycling is the potential to optimize our cash flow. By consolidating or refinancing our loans, we can often secure more favorable interest rates or repayment terms, resulting in reduced monthly payments and increased disposable income.

Imagine the relief of having extra money in your pocket every month. With debt recycling, you can redirect those savings towards other financial goals, such as building an emergency fund, investing in your retirement, or even treating yourself to a well-deserved vacation.

Moreover, as we invest in appreciating assets, the income generated can supplement our overall financial stability, providing an additional source of wealth accumulation. Whether it’s real estate, stocks, or other investment opportunities, the returns from these assets can contribute to our financial well-being and help us achieve our dreams. You can also read about tax incentives for early-stage investors by clicking here.

Picture yourself receiving regular dividends from your investments, adding to your income and giving you the freedom to pursue your passions. Debt recycling can make that a reality.

Long-term Impact on Wealth Accumulation

Strategic debt recycling sets the stage for long-term wealth accumulation. By diligently recycling our debt towards productive investments, we can build a robust portfolio of appreciating assets. Over time, the compounded returns from these investments can propel us towards our financial goals and enhance our wealth accumulation exponentially.

Imagine the satisfaction of watching your investments grow steadily, year after year. With strategic debt recycling, you can harness the power of compounding and watch your wealth multiply. It’s like planting a seed and witnessing it grow into a mighty tree, providing shade and shelter for generations to come.

Furthermore, debt recycling allows us to take advantage of market opportunities. As we pay down our debt and free up available credit, we can seize favorable investment opportunities that arise. Whether it’s acquiring undervalued assets or participating in lucrative ventures, debt recycling gives us the flexibility to capitalize on these opportunities and further enhance our wealth accumulation.

Imagine being able to take advantage of a once-in-a-lifetime investment opportunity that could potentially change your financial future. Debt recycling can open doors to such possibilities.

In conclusion, strategic debt recycling is not just about managing our financial obligations; it is a powerful tool that can transform our financial lives. By optimizing our cash flow, investing in appreciating assets, and leveraging market opportunities, we can achieve long-term wealth accumulation and secure a brighter future for ourselves and our loved ones.

Risks and Challenges in Strategic Debt Recycling

While the concept of strategic debt recycling holds immense potential, it is crucial to be cognizant of the potential risks and challenges that accompany this strategy.

Potential Pitfalls in Debt Recycling

One potential pitfall lies in the mismanagement of debt. Without a solid plan and disciplined approach, the benefits of debt recycling may be outweighed by the risks of accumulating further debt or investing in underperforming assets.

Additionally, incorrect valuation or overestimation of asset growth potential may lead to disappointing returns. A thorough understanding of the market trends and careful selection of assets are vital to mitigate such risks.

Mitigating Risks in Debt Recycling

To mitigate the risks involved in strategic debt recycling, it is advisable to seek professional financial advice. Experts in the field can offer crucial insights and help navigate the complexities of the investment landscape. Additionally, regular monitoring of investments and periodic review of the debt portfolio are essential to identify and address any potential risks in a timely manner.

Implementing Strategic Debt Recycling in Personal Finance

Implementing strategic debt recycling requires careful planning and thoughtful execution. Here are some key considerations to keep in mind to kickstart your debt-recycling journey.

Preparing for Debt Recycling

Before diving into debt recycling, a comprehensive evaluation of our financial situation is vital. Assessing our current debts, assets, and income sources enables us to adopt an informed approach. Creating a budget and identifying surplus funds that can be allocated towards investments is an important first step.

Furthermore, researching various debt consolidation or refinancing options and evaluating their suitability based on our circumstances is crucial. A well-structured debt consolidation plan can optimize our financial position, creating a solid foundation to commence our debt recycling strategy.

Monitoring and Adjusting Your Debt Recycling Strategy

Once embark on the debt recycling journey, it is essential to keep a close eye on the performance of our investments and the progress of our debt reduction. Regularly monitoring these aspects ensures that necessary adjustments can be made promptly. Market conditions, interest rates, and personal circumstances are continually evolving, and adapting our strategy accordingly increases the chances of success.

In conclusion, strategic debt recycling offers a unique opportunity to transform liabilities into wealth-building assets. By understanding the fundamental principles, implementing a structured plan, and mitigating associated risks, we can tap into the potential that lies within our existing debts and pave the way for long-term financial stability and prosperity.